Key Asset Classes Explained (And Why Smart Investors Need To Know About Them) – 2024 Update

Whether you’ve been investing for a while, or are planning to take your first step towards building your portfolio, chances are you already know a little bit about investing. You probably already understand that as you increase the risks on your investment portfolio, you tend to also increase the potential rewards over the longer term.

But do you fully understand the risks versus rewards of the key asset classes available to you and how best to balance them to meet your own needs?

After all, ensuring you completely understand the different asset classes available for your hard-earned investment dollar – and what risks and rewards those classes are likely to carry – is important to really maximise the potential of your investment portfolio.

It’s also important to consider the characteristics of the asset classes you’re investing in alongside your own personal needs. For example, if you’re planning to retire in the next few years, perhaps lower-risk assets may make up a larger percentage of your portfolio than if you’re just at the start of your investing career.

Before we start, let’s define exactly what ‘asset class’ means. An asset class is a grouping of investments that share the same characteristics, have similar risks and returns are subject to the same laws. They tend to behave the same way and react to similar changes in market conditions.

We’ve listed key asset classes below, in order of lowest risk to highest risk.

Cash

Whether it’s money in the bank, a term deposit, or hundred-dollar bills stuffed under the mattress – cash is, at face value, the safest and least volatile asset class. The only return from cash is interest (although not if you practice the under-the-mattress investment technique, which we don’t recommend), which means there is no capital growth on your investment. Cash also produces the lowest returns over the long term and, if you’re unlucky, you may see those returns swallowed up by inflation along the way.

Common forms of cash investments include term deposits, bank deposits and saving and cheque accounts. If you’re looking for a really low-risk place to store your money, and aren’t too worried about getting good returns, a cash investment may be for you. Cash investments play an important role in diversified portfolios, providing a solid and stable base investment that is likely to grow – albeit slowly – over time.

Fixed Interest

Fixed interest investments are a little bit higher on the risk versus reward scale. While less stable than cash investments, fixed interest investments are still considered safe. They include government and corporate bonds, bills, notes and debentures. Bonds generally produce a good income, although this can fluctuate somewhat due to changes in interest rates as they’re bought and sold.

Australian government bonds are considered some of the safest in the world.

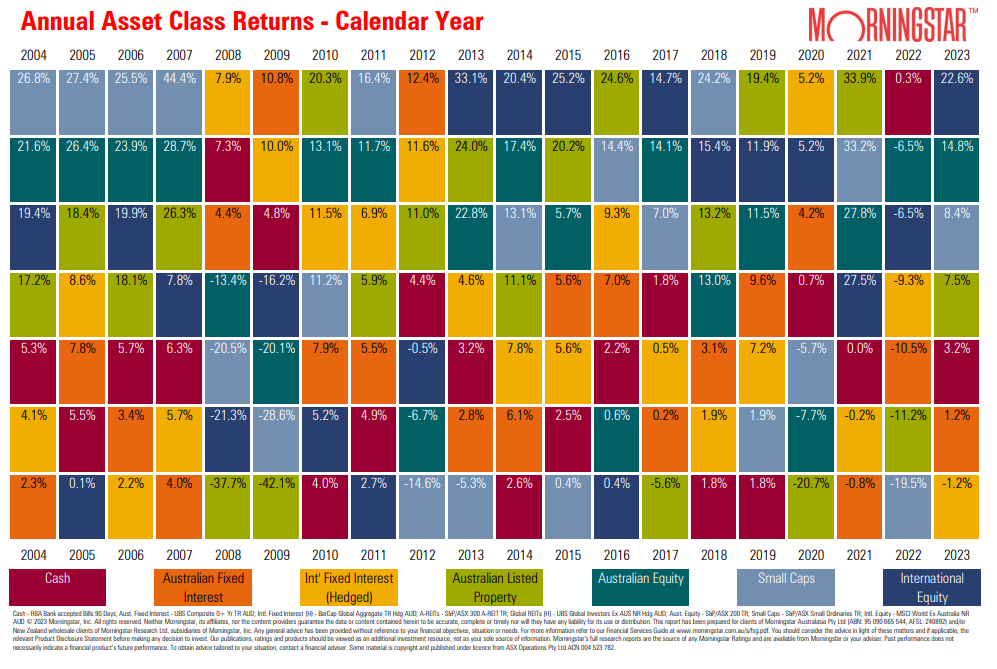

Source: Morningstar

Property

Ever heard the expression ‘safe as houses’? Real estate tends to be viewed as one of the safest places to invest and many people who otherwise have little experience in investing often look to investment properties first. Being able to see, touch and feel your investment can bring peace of mind and the concept of investing in property is an easy one to understand even if you’re not strongly financially experienced.

It can therefore surprise investors to learn that property is towards the higher end of the risk chart. Investors can choose from many different types of residential and commercial property, each with varying risk and return characteristics. The property market is cyclical, and can experience downturns, but it can also provide steady and reliable income, along with good prospects of capital growth when chosen well. The key is to choose wisely and plan for the long-term. If you’re willing to let your investment grow over time, weather the storms of cyclical ups and downs and do your research before you begin, property can play an important role in a strong diversified portfolio.

Shares

Shares are considered high-risk investments, but they also offer high returns to long-term investors. Many ‘blue-chip’ shares also provide income via dividends. As you know, share prices can move up and down over short time periods, causing anxiety for some investors. If you invest in the next Google or Apple, the returns can be spectacular – but for every Google or Apple, there’s been many failed ventures along the road. The key is to plan for the long-term and to not let the bumps along the road worry you too much. Of course, if you’re planning to retire in the next couple of years, having too many eggs in the share market basket can be very risky. Shares are a great long-term strategy for wealth-building, but it pays to diversify into other areas as well.

Alternative Assets

Some investments don’t fit neatly into the previous classifications, so portfolio managers place them into an ‘alternative’ asset class. This may include infrastructure investments – such as airports and toll roads – and absolute returns funds, which rely on trading strategies for their performance.

By altering the proportion of funds allocated to each asset class, portfolios can be constructed across the full spectrum of risk and return.

The key is to know what your objectives are for investing before you begin and to plan accordingly. If you’ve got 30 years and are looking to retire with millions, you’ll undoubtedly choose a different strategy than someone planning to retire next year who’s looking to safely maximise what they’ve already earned over their lifetime.

It’s important to diversify and plan for a strategy that works for you and your goals.

Interested in earning up to 8.05%^p.a. paid monthly?

To start earning superior distributions of up to 8.05%^p.a. paid monthly, request your free information pack or talk to our Investor Relations team on 1300 737 274 about investing in the Skyring Fixed Income Fund.

You can get started with as little as $10,000. You’ll receive your returns within the first five days of every month, just like clockwork.

Download the PDS and Information Pack here. Click here for more details.

^Please note, past performance is not a reliable indicator of future performance. An investment in the Fund is not a bank deposit and is subject to investment risk.

———-

Important:

This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee take any responsibility for any action or any service provided by the author.

Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.