30 April 2025 Private credit has seen remarkable growth in recent years, attracting more

investors looking to diversify their fixed income portfolios. Its strong risk-adjusted

returns offer stability and predictability, even in shifting market conditions.

If private credit isn’t part of your portfolio yet, now could be the right time to

explore the opportunities it offers… Invest today with Skyring Income Funds. Private credit, at its core, is the lending of capital from private individuals or

institutions to businesses outside the traditional banking system. While

commercial transactions can be complex, private credit offers a flexible and

tailored approach to financing, often filling gaps left by banks.

As an investment class, private credit is broad, encompassing lending activities by

non-bank financial institutions such as private credit funds, private equity firms,

and alternative asset managers. These entities raise capital from investors seeking

stable returns and deploy it through strategies like direct lending, mezzanine

financing, and distressed debt.

Given the diverse nature of private credit products, thorough due diligence is

essential for investors. Understanding the composition of a private credit portfolio,

the structures in place, and the expertise of the fund manager in navigating

different economic cycles is critical to assessing risk and return potential.

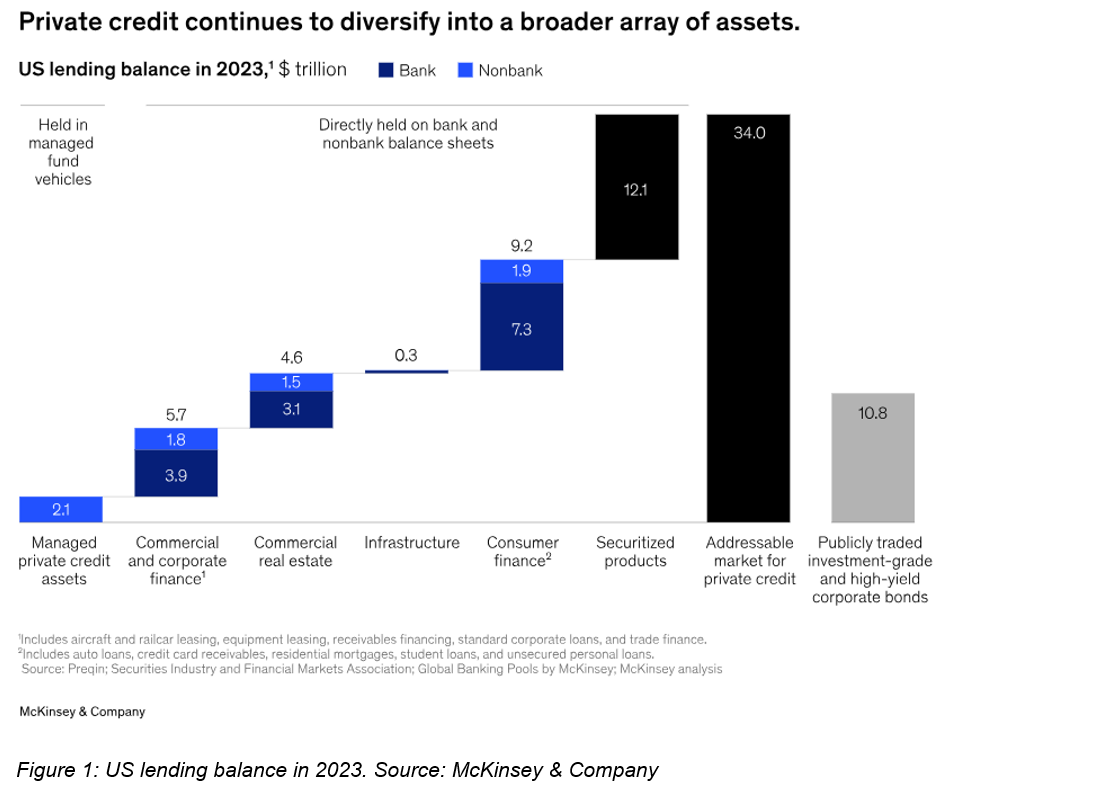

Global private credit assets under management (AUM) surged to US$2.1 trillion in

2023, roughly ten times the 2009 value, with some projections estimating the

United States addressable market for private credit could reach more than US$34

trillion alone (Figure 1).

Private credit has become a key component of Australia’s fixed income markets,

with more investors incorporating it into their fixed income portfolios.

While Australia’s market is smaller, private credit has expanded rapidly, with

private corporate credit AUM grown from $35 billion assets under management in

2018 and reaching an estimated $188 billion by the end of 2023.

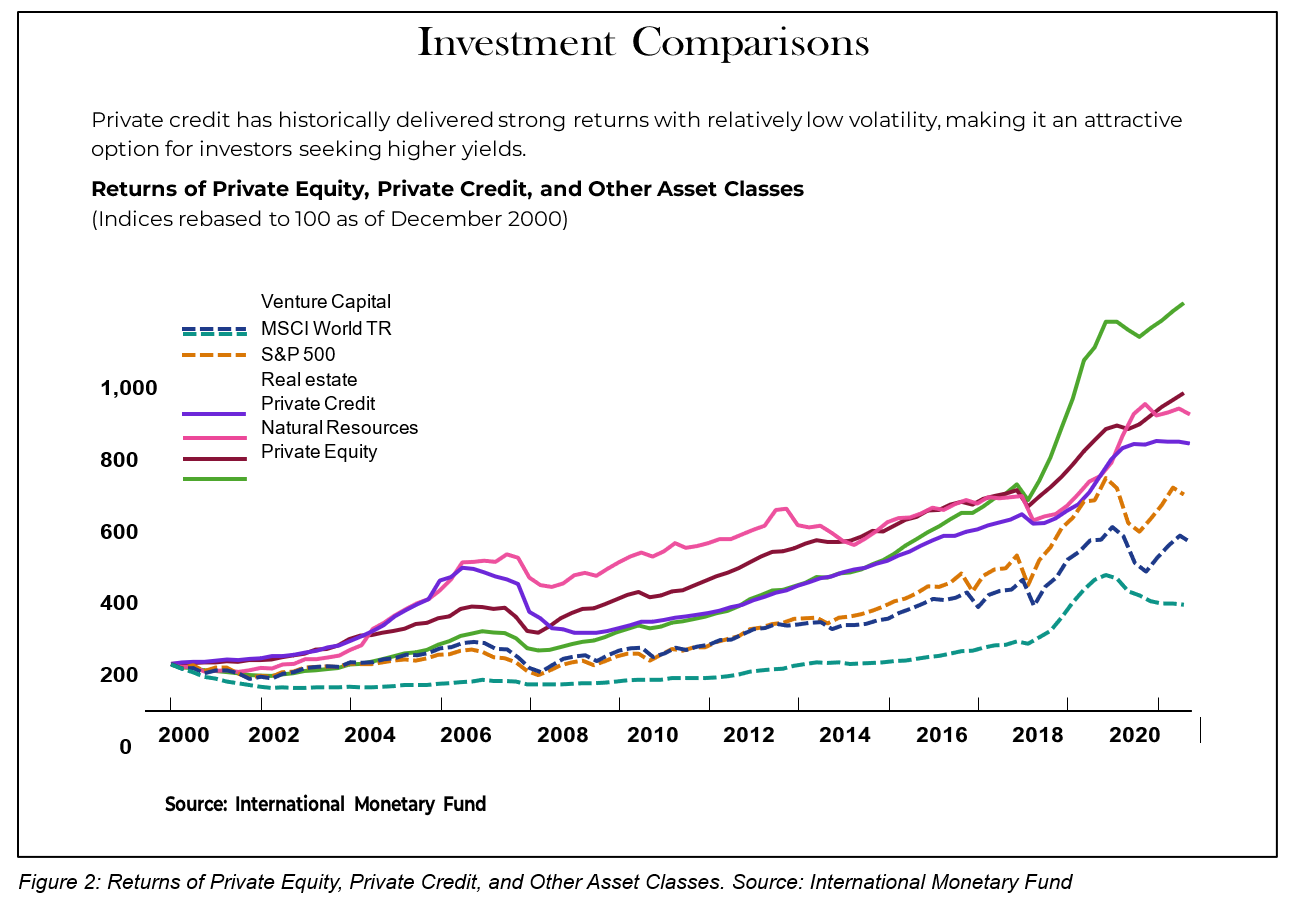

Investors are increasingly turning to private credit funds for good reason: they offer

appealing risk-adjusted returns with relatively low volatility. As shown in Figure 2,

private credit has historically delivered strong returns, making it an attractive

option for those seeking higher yields without the volatility commonly found in

global bond markets.

Investors are allocating more capital to private credit due to several compelling

factors:

What’s often less highlighted is why so many borrowers are also drawn to private

credit. There are several key trends driving this shift.

First, private equity firms are increasingly relying on private credit for financing,

attracted by its greater certainty and faster execution compared to traditional

bank loans.

Second, the rise of ‘special situations’ lending is creating new opportunities for

private credit. In these cases, private credit can meet unique funding needs that

traditional banks may struggle to assess, offering investors the potential for higher

returns when supported by thorough due diligence.

These trends point to a strong and sustained growth trajectory for private credit,

highlighting the reasons why both investors and borrowers are increasingly

turning to this asset class.

Partnering with an experienced fund manager with a proven long-term track

record is the optimal strategy for accessing this growing asset class.

Through our Skyring Fixed Income Fund

and

Skyring Platinum Fixed Income Fund

, we provide investors with a risk-managed, income-focused approach to private credit investing.

At Skyring, we remain dedicated to providing products which deliver income and low volatility at all points along the economic cycle.

Our friendly Investor Relations Team is available to discuss on 1300 73 72 74.

Learn more about how to invest with Skyring:

The Rise of Private Credit

What is Private Credit?

A Rapidly Expanding Global Market

The Australian Private Credit Market

Private Credit’s Expanding Role in Investment Portfolios

Why Investors Are Turning to Private Credit

Why Borrowers Are Turning to Private Credit

Invest with Us