Three Investment Diversification Strategies To Minimise Potential Losses And Improve Investment Return Over The Long-Term

When it comes to building long-term wealth, there are a few golden rules that can really make a difference. One – and perhaps the most crucial – is not to put all your eggs in one basket.

We’ve all heard the adage. In fact, we’ve probably all heard it many, many times.

And yet, even the most experienced investors can be lured by the promises of a high-performing fund, or a particularly tempting once-in-a-lifetime opportunity.

It pays to remember that when it comes to your finances, no single investment will continually outperform all other investments, all of the time. All markets have their ups and downs and, unless you happen to have invented a crystal ball (in which case, your financial future is looking pretty solid no matter how you’ve invested) you will never really know what’s around the corner.

It’s not only markets that can be inconsistent. We have different financial needs at different stages of life and, as we move closer to retirement, it becomes even more important to ensure our investments are stable.

If you’re past the wealth accumulation stage of your life, you’ve got less ability to recover from potential financial ups and downs so it pays to be more defensive in your thinking and look to options like fixed income funds with strong returns. Not only do these help you adjust to market fluctuations, they can also provide peace of mind at a time of life when you’re looking to the horizons with a new sense of freedom.

Clearly, to minimise potential losses and improve investment return over the long-term, you must diversify your portfolio across various investments.

However, not all diversification strategies are created equal. Here’s our tips to spreading your portfolio and shoring up your financial future in the process.

Diversify across asset classes

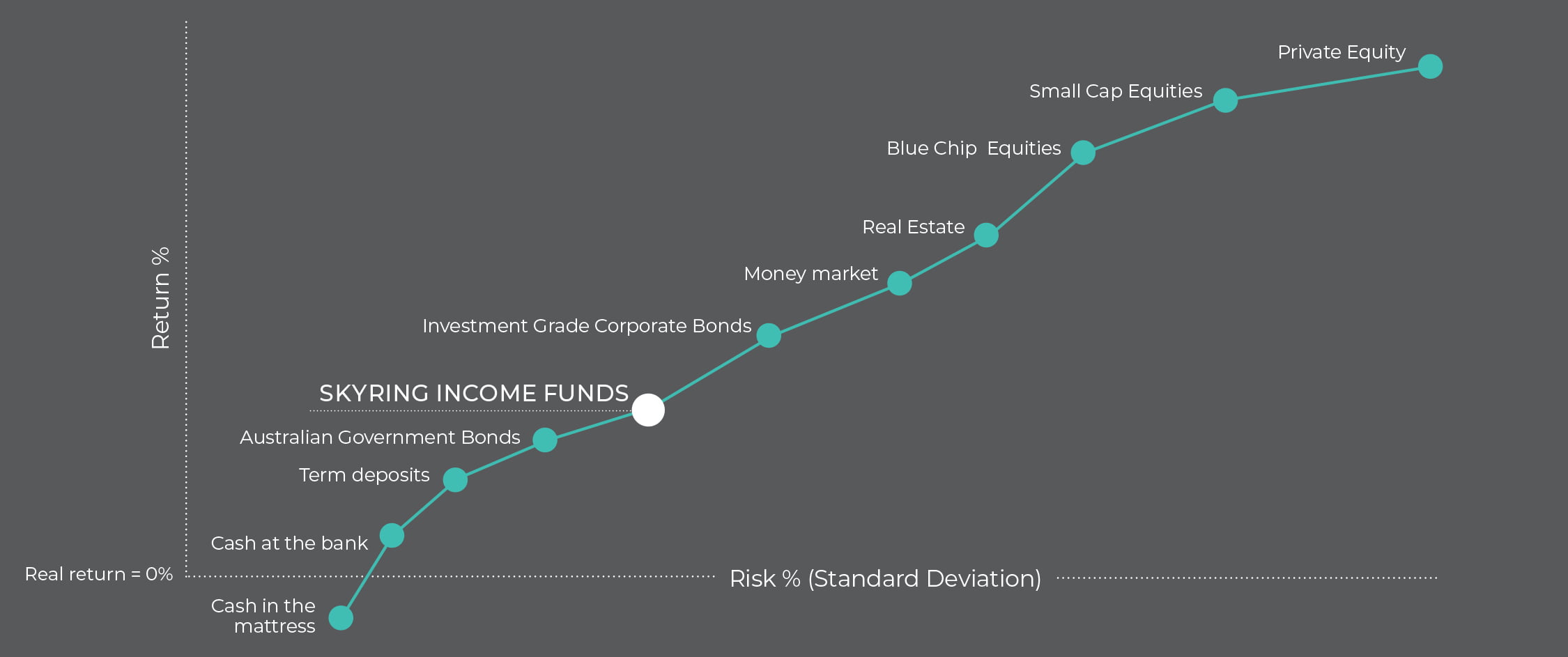

The building blocks of a strong diversified portfolio are to ensure you invest across asset classes. Look to include a mixture of equities, fixed interest, property and cash investments.

Your equities could include both Australian and international shares. Fixed interest investments could include government, semi-government and corporate bonds. If you invest in property, you could look to incorporate residential, retail and commercial properties. Cash options include includes term deposits and at-call cash accounts.

Look to your lower risk assets, including fixed interest and cash, to protect your capital when the market is bumpy. On the other hand, higher risk assets – such as your share portfolio – can deliver good returns during the boom times.

Holding a mix of asset classes may help to provide more stable returns over the medium to longer term as markets rise and fall.

Diversify within asset classes

To further strengthen your investments, look to spread them between different investments within the same asset classes too. For example, you may decide to invest in a range of investment properties and choose to spread that investment across commercial and residential properties. Now, you may look to different markets within the country – for example, different states or cities – to ensure you can better weather any storms in each individual market.

You may also look to spread your share portfolio across different industry sectors, because certain sectors will outperform others as the global marketplace evolves.

For example, investing heavily in mining would once have been considered a strong strategy. The Australian resources industry helped keep Australia’s economy a shining light against a gloomy international backdrop following the Global Financial Crisis and, had you invested heavily 15 years ago, you would have done quite well indeed.

Now, the mining sector is facing volatile conditions and its long-term future prospects look far less predictable. Buying up shares in other sectors as well would be advisable to reduce any future bumps along the road.

Diversify managers within asset classes

Not all managers were created equal. However, even if you found all the best financial managers in Australia and put them in a room together, you’d still find a range of strategies, approaches and outcomes achieved across the asset classes they invest in.

In short, it can pay to move your investments around a bit. Different managers have different strengths and just because your share guy is a whizz on the ASX, doesn’t mean you should trust his tips in property or fixed income alternatives.

Ensure your investment future is bright by spreading your investments between managers to ensure risk is minimised and returns are consistently strong.

It can be simple

It pays to remember that you don’t have to overcomplicate things. Even a relatively modest investment can achieve strong results over time with a smart strategy. Diversify that modest investment and your returns are likely to be stronger and more reliable over both the short and long-terms.

The other golden rule to remember is to never invest in something you don’t understand. If you can’t get your head around an opportunity and how exactly it’s going to bring you financial rewards down the track, you should probably save your hard-earned dollars. Find advisors or an investment partner who’s willing to take the time to guide you through your options and how exactly they work, as well as the risks and rewards attached.

Skyring specialises in providing investors attractive regular income investments as part of a diversified Fixed Income portfolio.

For investors who are frustrated by the returns offered by term deposits, cash accounts, shares, or traditional property investment opportunities, the Skyring Fixed Income Fund offers a great alternative. The Skyring Fixed Income Fund is not a bank deposit which means we are able to offer this and more:

Interested in earning up to 6.50%^p.a. paid monthly?

To start earning superior distributions of up to 6.50%^p.a. paid monthly, request your free information pack or talk to our Investor Relations team on 1300 737 274 about investing in the Skyring Fixed Income Fund.

You can get started with as little as $10,000. You’ll receive your returns within the first five days of every month, just like clockwork.

Download the PDS and Information Pack here. Click here for more details.

^Please note, past performance is not a reliable indicator of future performance

———-

Important:

^The rates of return from the Fund are not guaranteed. An investment in the Fund is not a bank deposit.

This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee take any responsibility for any action or any service provided by the author.

Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.